r&d tax credit calculator 2019

Use our free no. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

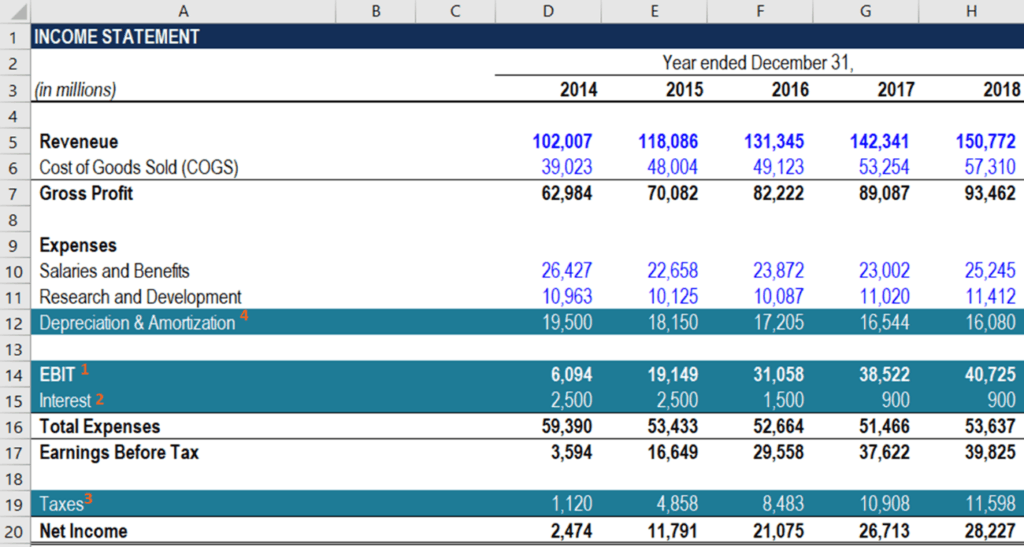

Interest Tax Shield Formula And Calculator Excel Template

Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a.

. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Plus it carries forward. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

50 of 48333 is 24167. Let Kruze Consulting handle your startups RD Tax Credit analysis. The results from our RD Tax Credit Calculator are only.

45833 multiplied by 14 is 6417this is your RD tax credit amount. If you spend 200000 on RD you can knock just under 50000 off your Corporation tax bill for that year. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

The credit benefits large and small companies in virtually every. This is a dollar-for-dollar credit against taxes owed. You can then offset the.

The current rate for the RDEC is 13. This bill modifies the refundable research tax credit for new and. If your SME qualifies for RD tax relief your company will be able to.

The RDEC is paid as a taxable credit of your RD costs. The Kruze Consulting RD Tax Credit Calculator is designed to estimate your RD tax credit using Federal Form 6765. Discover Helpful Information And Resources On Taxes From AARP.

70000 minus 24167 is 45833. The money companies spend on technology and innovation can offset payroll and income taxes through RD Tax Credits. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Risk free no obligation. Let our experts research. Average calculated RD claim is 56000.

Ad Everything is included Premium features IRS e-file 1099-MISC and more. In 2021 alone alliantgroup delivered over 23 billion in credits and incentives to over 14000 businesses. Free RD Tax Calculator.

All Extras are Included. The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

How to calculate the RD tax credit using the traditional method. Use Titan Armors calculators to estimate your state and federal RD tax credit benefits or to see if you can offset your payroll tax. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base. Plug in your numbers 3Get your RD tax credit estimate. Tax credits calculator -.

Estimate your tax savings using our quick. RD Tax Credit Calculator. What is the RD tax credit worth.

The RD tax credit is an excellent tool to accomplish cash goals by recouping current and previous-years expenses for ongoing and completed qualified projects. For a loss-making SME RD tax credits will be given in the. And we do not want to stop here without helping you.

Access our free calculator 2. Introduced in Senate 07232019 Research and Development Tax Credit Expansion Act of 2019. Because it is taxable the cash benefit youll receive is 11 after tax.

Calculate how much RD tax relief your business could claim back. The research and development RD tax credit is a powerful resource that can help you. For most companies the credit is worth 7-10 of qualified research expenses.

Premium Federal Tax Software. Its easy and free. This result in this.

The RD tax credit is now permanent and for the first time ever small businesses and start-ups can take advantage of this lucrative tax credit.

Canada Capital Gains Tax Calculator 2022

Tax Credit Calculator Sunnybrook Foundation

This Infographic From The National Taxpayer Advocate Highlights Some Of The Most Serious Problems Faxing Taxpayers Today Tax Serious Problem Infographic Irs

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Employment And Support Allowance Esa Contact Number Supportive Employment Find A Job

Income Tax Calculator App Concept Calculator App Tax App App

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

How To Calculate Fcfe From Ebit Overview Formula Example

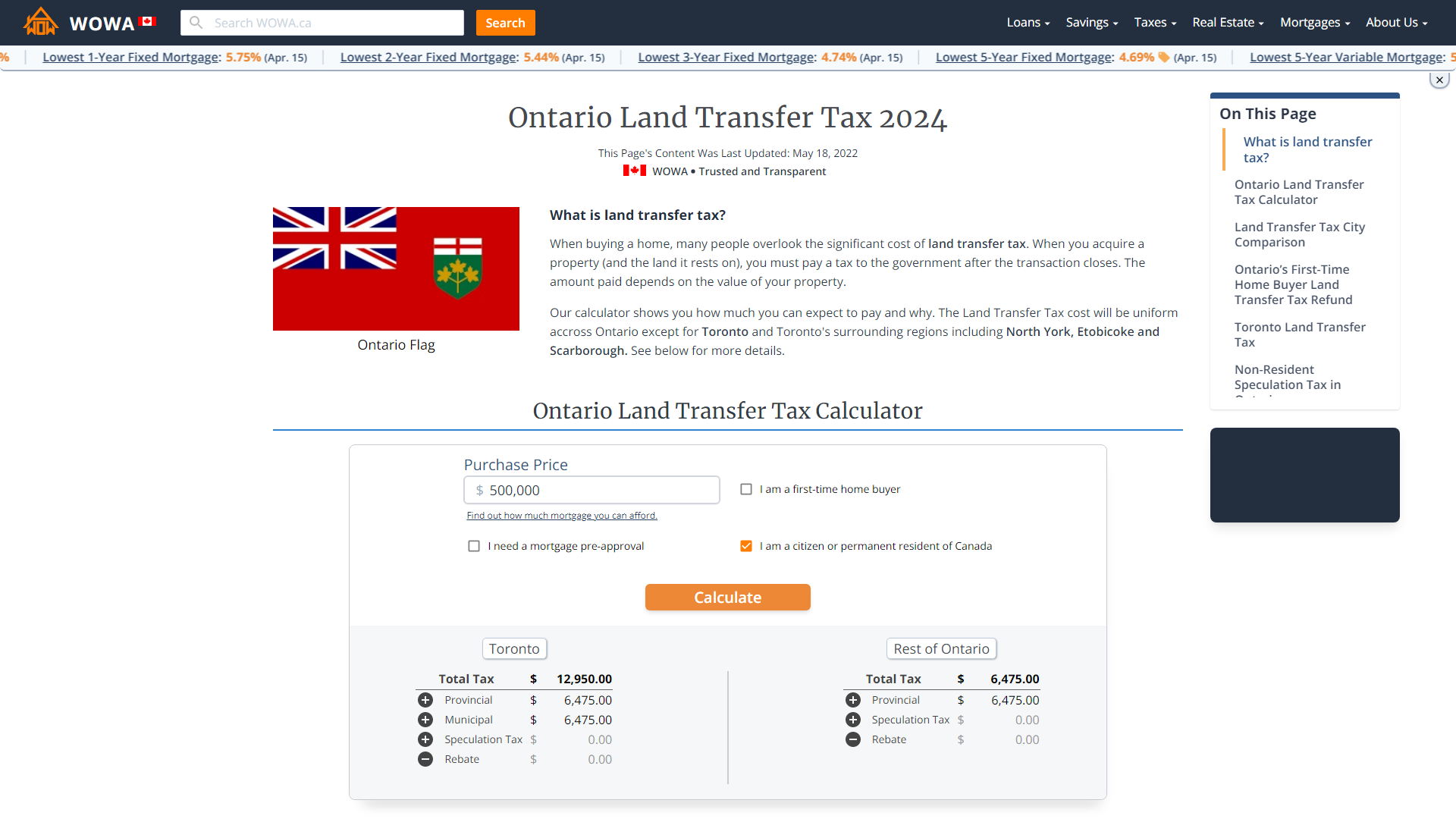

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Taxtips Ca Ontario Non Refundable Lift Credit

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Net Operating Losses Nols Formula And Calculator Excel Template

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Earlyretirement Retirement Calculator Early Retirement Retirement

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)